80G / 12AA

- No Hidden Charges

- Experts in APEDA

- Free Expert Assistance for Lifetime

Now apply for your 80G / 12AA from your place quickly and easily. (Takes less than 30 days)

₹ 4999 + Gov fess

2 Lakhs

Happy Customers

300+

Professionals

250+

Partners

What is 12A / 80G

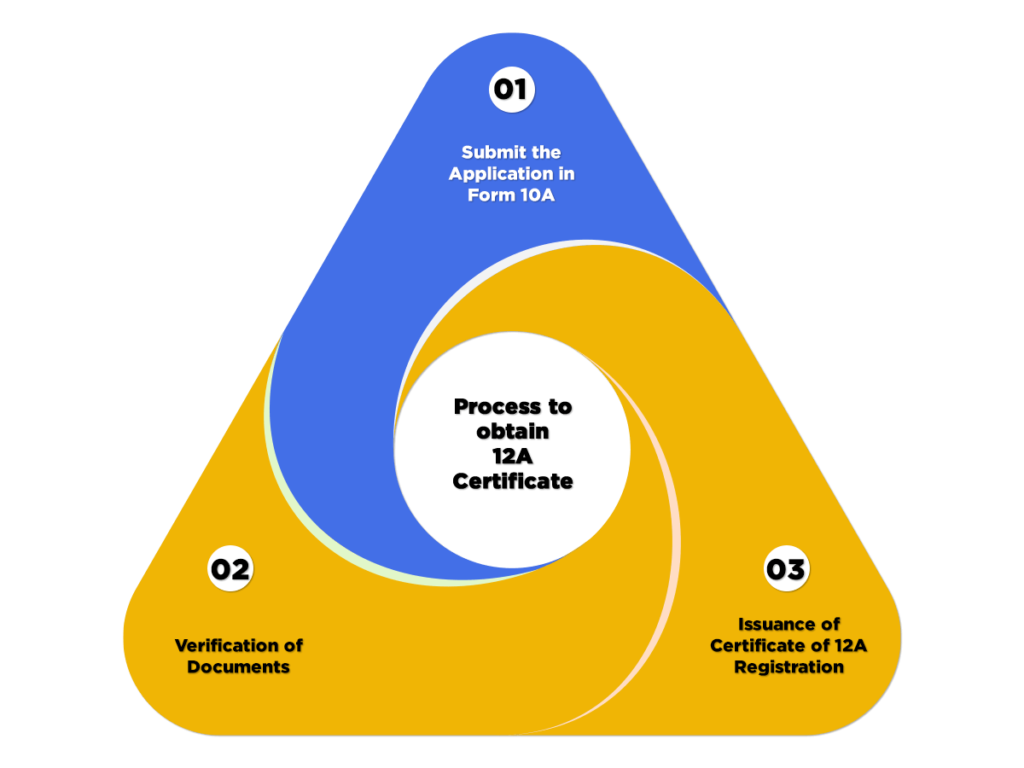

Income of an organization is exempted from Income Tax if an NGO has 12AB. If an organization has obtained under section 80G of Income Tax Act, then donors of that NGO can claim exemption from Income Tax. Application for under section 12AB and 80G can be applied just after the of NGO.

Application for under 80G and 12AB can be applied together or it can be applied separately. If an organization wants to apply for both separately, then application for u/s 12AB would be applied first. Getting 12AB is mandatory for application of u/s 80G of Income Tax Act, 1961.

REQUIRMENT

Form 10A for u/s 12AB & 80G

MoA in case of Section 8 Company and Society

Trust Deed in case of a Trust

Address proof where the organization is registered

NG

Bank account statement of last three years

List of donors along with their details

Activity and Progress/Project Report of past three years

Requirements of u/s 12AB / 80G

- The organization must be a registered NGO

- U/S 80G can be applied only after Section 12AB

- NGO should not have any income generated from a business

- The organisation must maintain a regular book of accounts in favor of their receipts and expenses

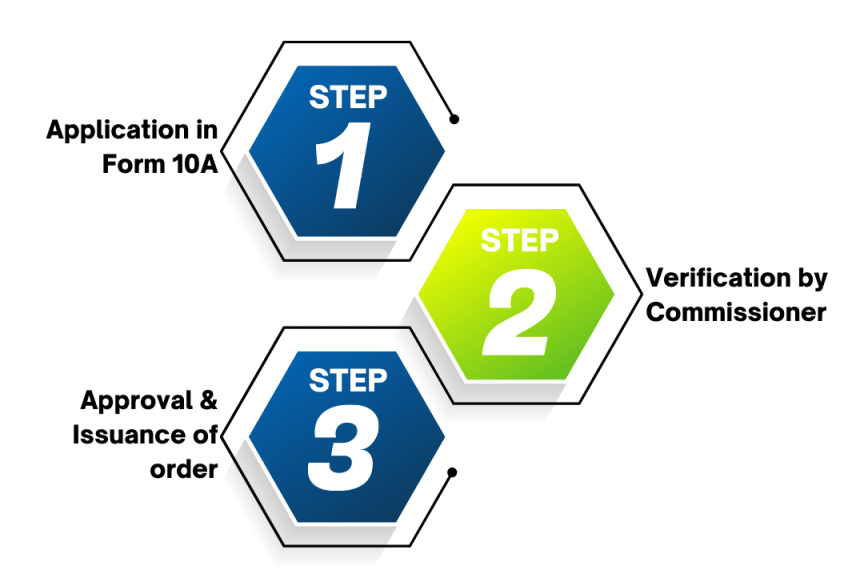

Procedure u/s 12AB

- Application for 12AB is made in Form 10A which is prescribed in Rule 17A of the Income Tax Act, 1962. It has to be filed with proper documents to Jurisdictional Principal Commissioner or Income Tax Comissioner (Exemptions).

- On receiving the application for , the Commissioner verifies the documents and genuineness of the NGO activities. He may call for additional documents and other information which he considers important or necessary.

- After verification, the Commissioner passes an order in writing for the grant of 12AB. If the Commissioner is not satisfied, he will reject the application, after which the applicant is provided a fair chance to be heard.

Procedure of u/s 80G

- Application for 80G is made in Form 10G. It has to be filed with proper documents to Jurisdictional Principal Commissioner or Income Tax Comissioner (Exemptions).

- On receiving the application for , the Commissioner verifies the documents and genuineness of the NGO activities. He may call for additional documents and other information which he considers important or necessary.

- After verification, the Commissioner passes an order in writing for the grant of 80G. If the Commissioner is not satisfied, he will reject the application, after which the applicant is provided a fair chance to be heard.

F.A.Q.

Income of an organization is exempted from Income Tax if an NGO is registered under section 12AB.

If an organization has obtained under section 80G of Income Tax Act, then donors of that NGO can claim exemption from Income Tax.

Application for 12AA is made in Form 10A. It has to be filed with proper documents to the Jurisdictional Principal Commissioner of Income Tax (Exemptions).

- The organization must be a registered NGO

- NGO should not have any income generated from a business

- The organisation must maintain a regular book of accounts in favor of their receipts and expenses

Application for 80G is made in Form 10G. It has to be filed with proper documents to the Jurisdictional Principal Commissioner of Income Tax (Exemptions).